Our vehicles can be a costly purchase, can’t they? If not for the initial outlay of buying the car, we can often forget about maintaining them, repairing them and even fueling them. All of which have a cost and they can surely mount up over time if you don’t take control of the situation.

Many of us have no choice but to own a car. We need a vehicle to get us to work, from one place to another, or to even just get our family safely to school. However, while so many of us focus on the actual cost of the car, there is little focus on the ongoing costs, and they can financially cripple you if you are not careful. This is why it is worth taking note of some of these things and budgeting for them, much as you would with other bills in your life. With that in mind, here are some of the ways you can combat that situation and make your car work better for you, financially speaking.

Don’t pay too much for insurance

Insurance can be a huge cost to you each month, or even annually if you are fortunate to pay in advance. But some people can be a little lazy with their insurance quotes meaning they spend far more than they need simply because they don’t change providers. Some people may think that changing insurance companies is a long and unnecessary task, but insurance companies are banking on that. Meaning you may be paying more than you should be each year for insuring your car. It’s simple to do, and with the use of comparison sites, you can easily change your insurance and get a cheaper quote the very same day if needs be. Of course, there are instances where your insurance is cheaper by staying with your current provider, but you won’t know that for sure unless you check.

Replace your car instead of hemorrhaging money

Replacing a car may seem like an expensive thing to do, but if your current vehicle is in the garage each week costing you a fortune then why wouldn’t you consider upgrading to a newer model? Often, people feel they don’t have the money to change their cars, but some dealers can help with finance options. While you may think to pay monthly is an unnecessary outlay, a newer car could come with a warranty meaning in the long term you are saving a fortune on potential repair costs. Overall it is worth costing in the benefits versus the cons of upgrading your vehicle. There could be savings to behad on duel because of better economy, insurance because of it being more secure, and even in the repairs and maintenance side of things. However, if the figures don’t work out then you know you have the most cost effective option for you right now.

Budget for repairs on a yearly basis

One big mistake people can make is not budgeting for wear and tear items throughout the year. These are things like brake pads and discs, tires, wipers and bulbs. All of which could need replacing at any given time. One of the biggest costs can be tires, and unless you speak with professionals like a mobile tire shop, you could end up paying out more than is needed. A great tip to avoid the financial hardship of this is to place a little money aside each week or month could help you get out of a sticky situation when it comes to your regular service.

Calculate your fuel costs each week

Finally, owning and paying for a vehicle is one thing, but running it is often a cost nobody budgets for. How much does it cost each week to get you to work and back? Have you got the right car for the type of mileage you drive? This is when simple online calculators can help you work out exactly how much you spend each week when driving your car. You can use these tools before you buy a car. This is because sometimes people assume that having a specific type of fuel, for example, a petrol car is going to be economical, when in some cases it might not be. It can also depend on how much miles you drive each week and month, as usage could mean a diesel is a better option, or even considering an electric vehicle in today’s current car market. It helps to budget for these things when it comes to being stricter with your finances.

Let’s hope these tips help you improve your motoring finances.

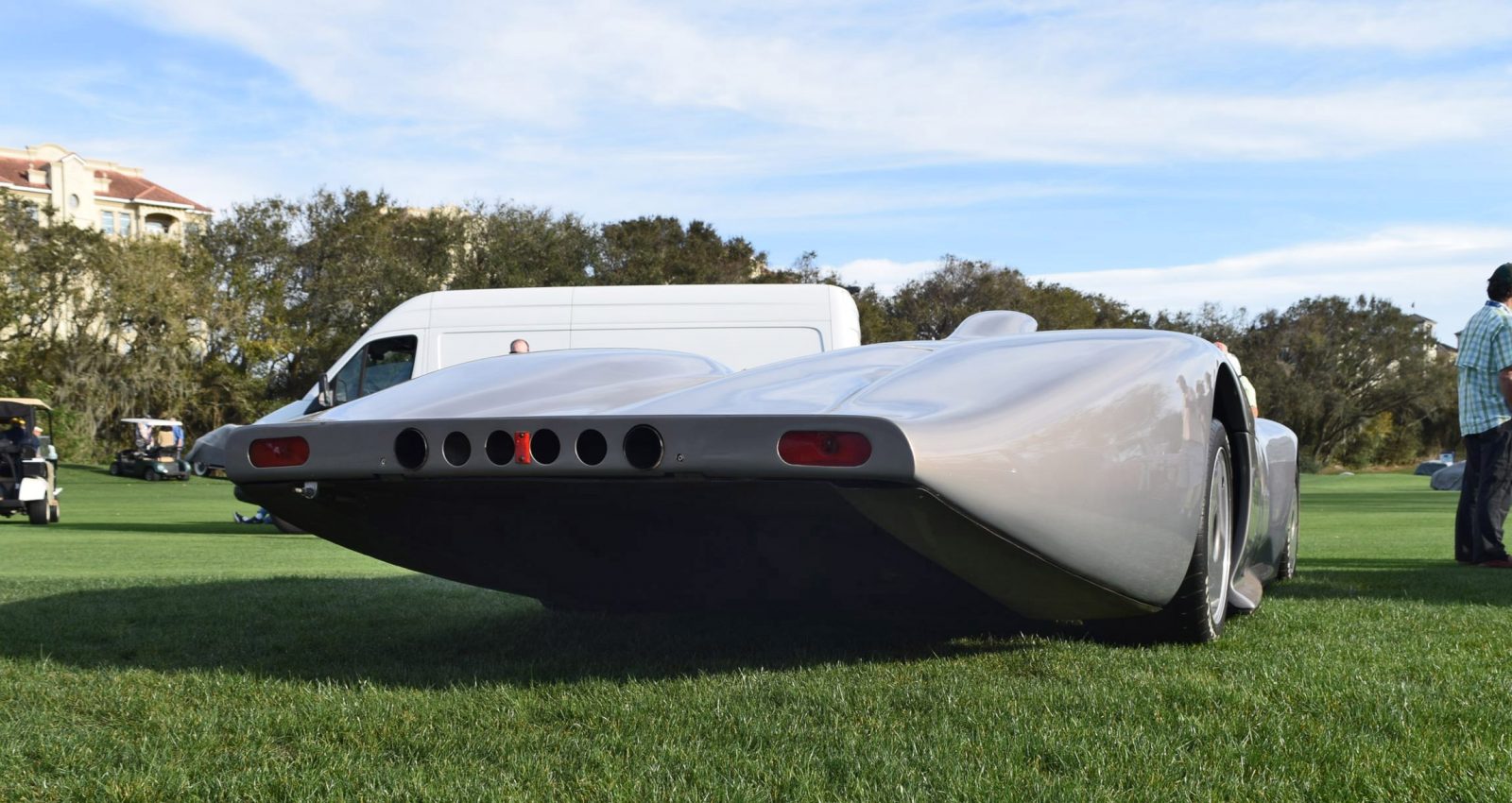

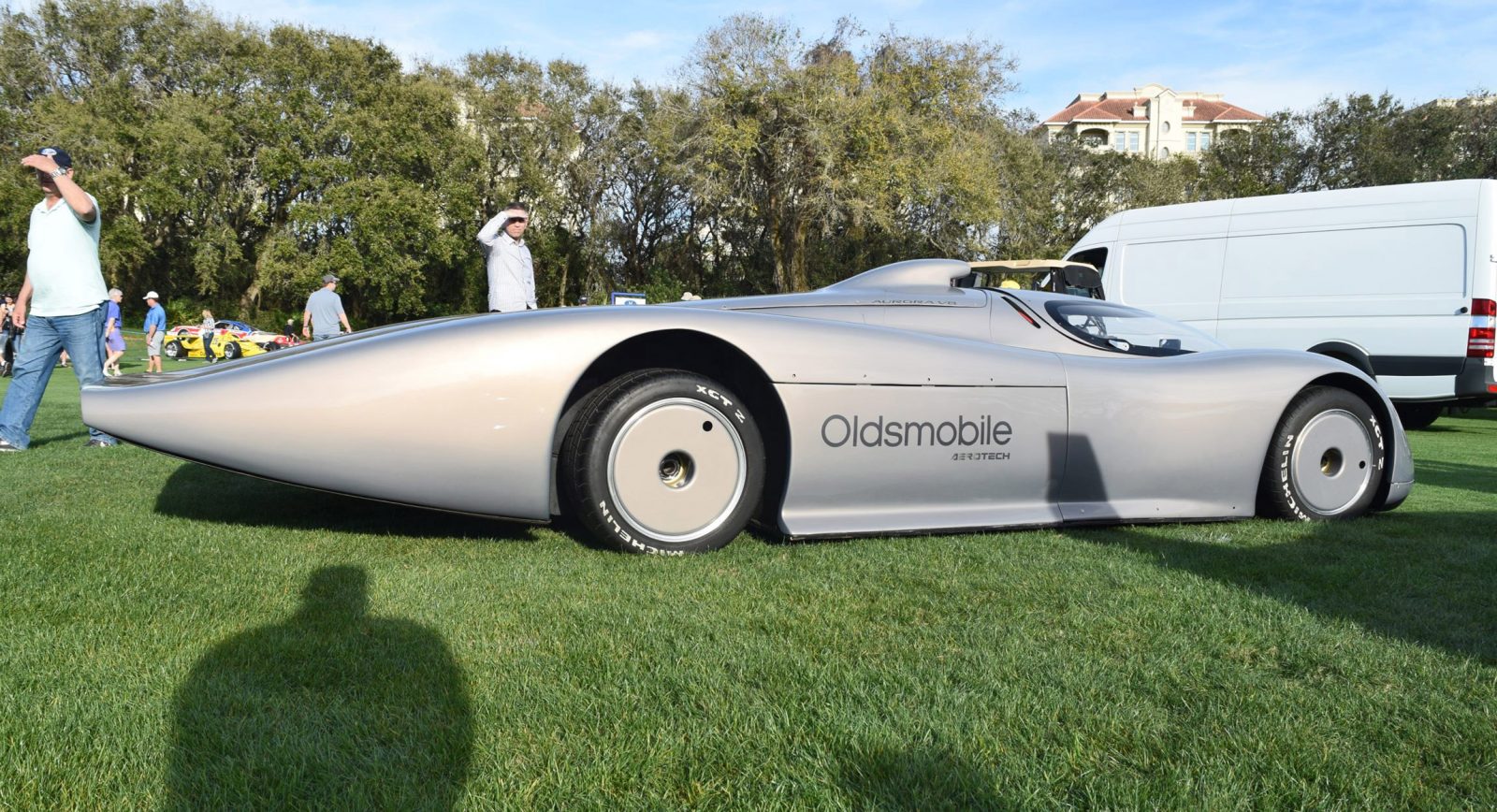

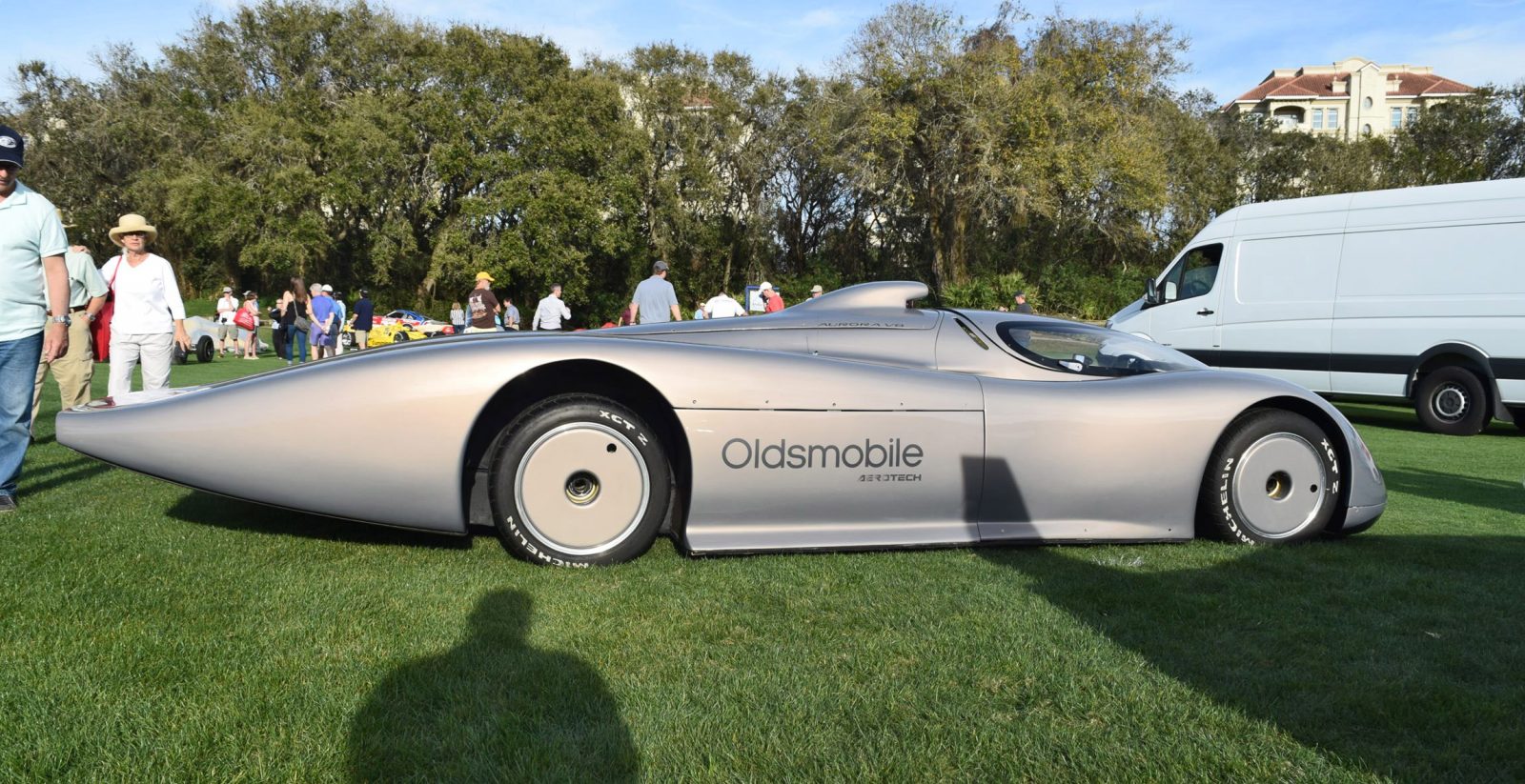

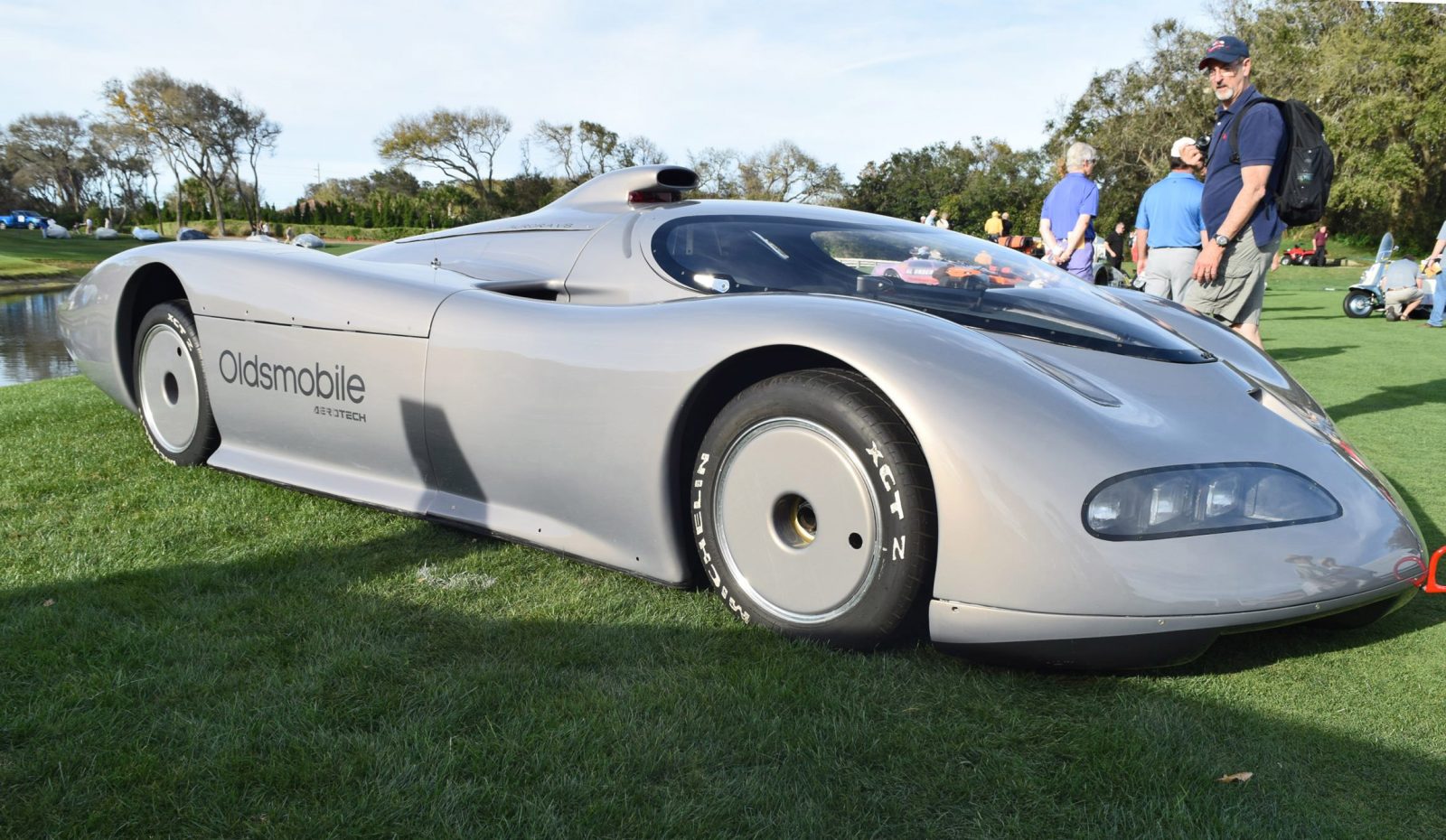

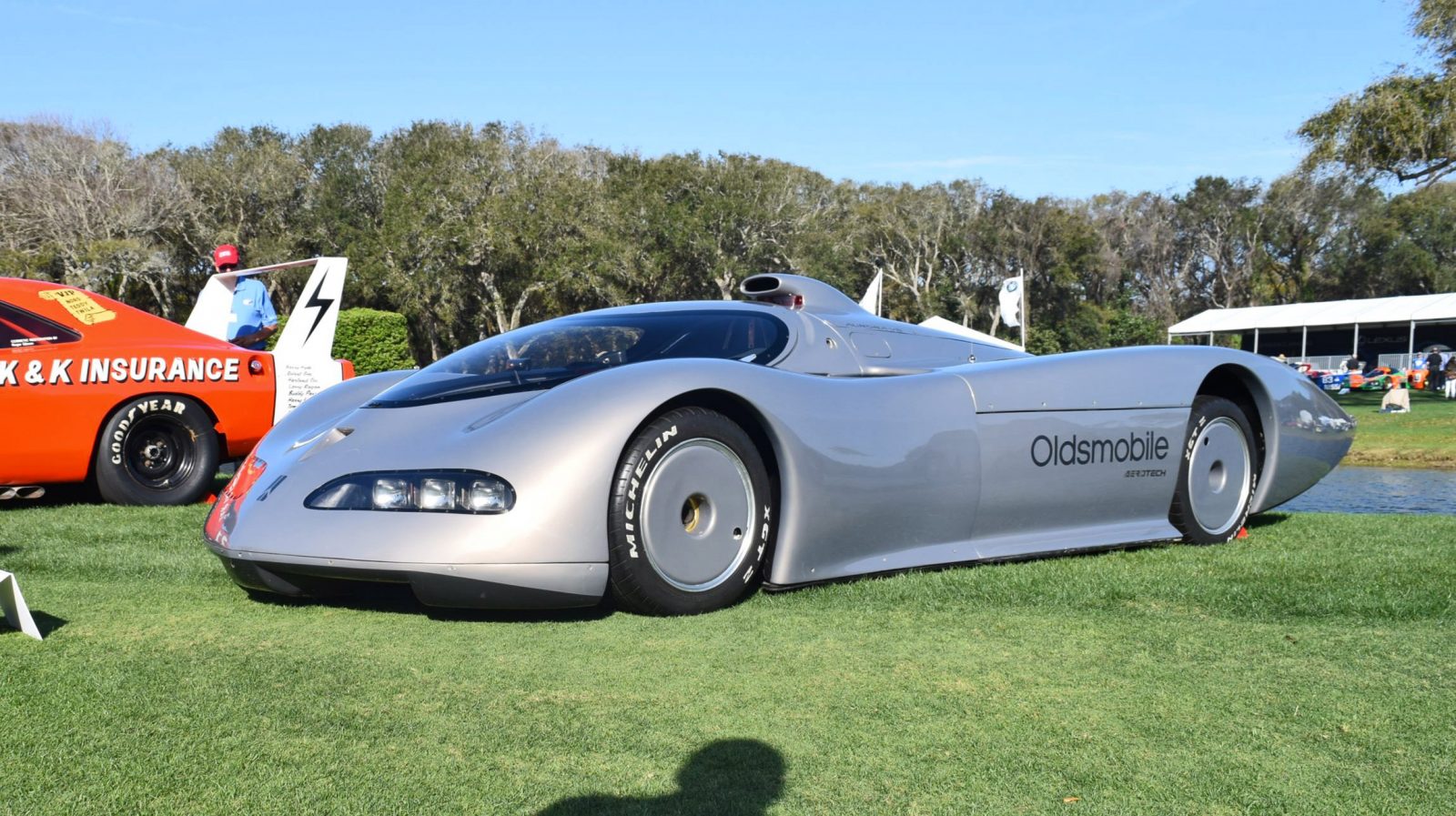

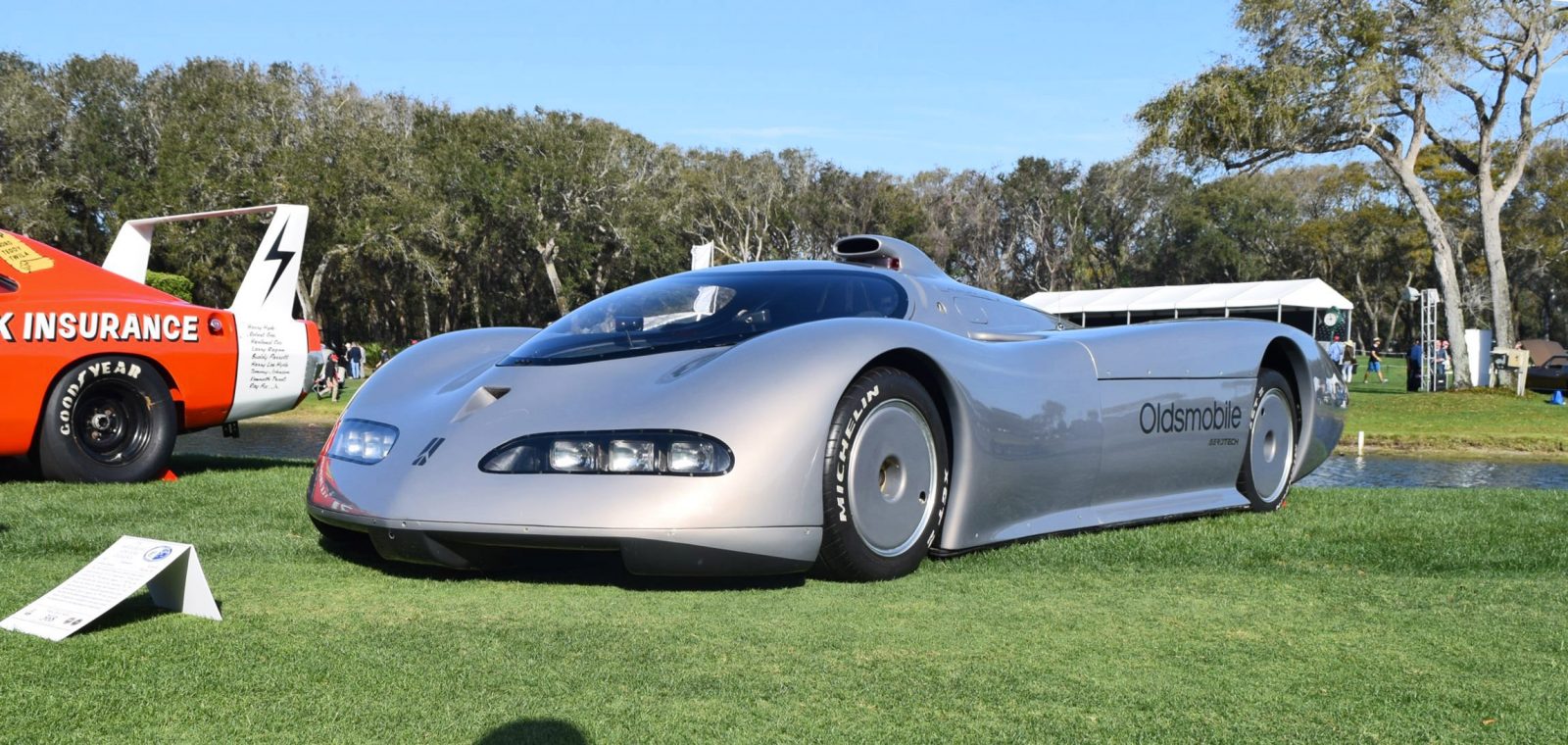

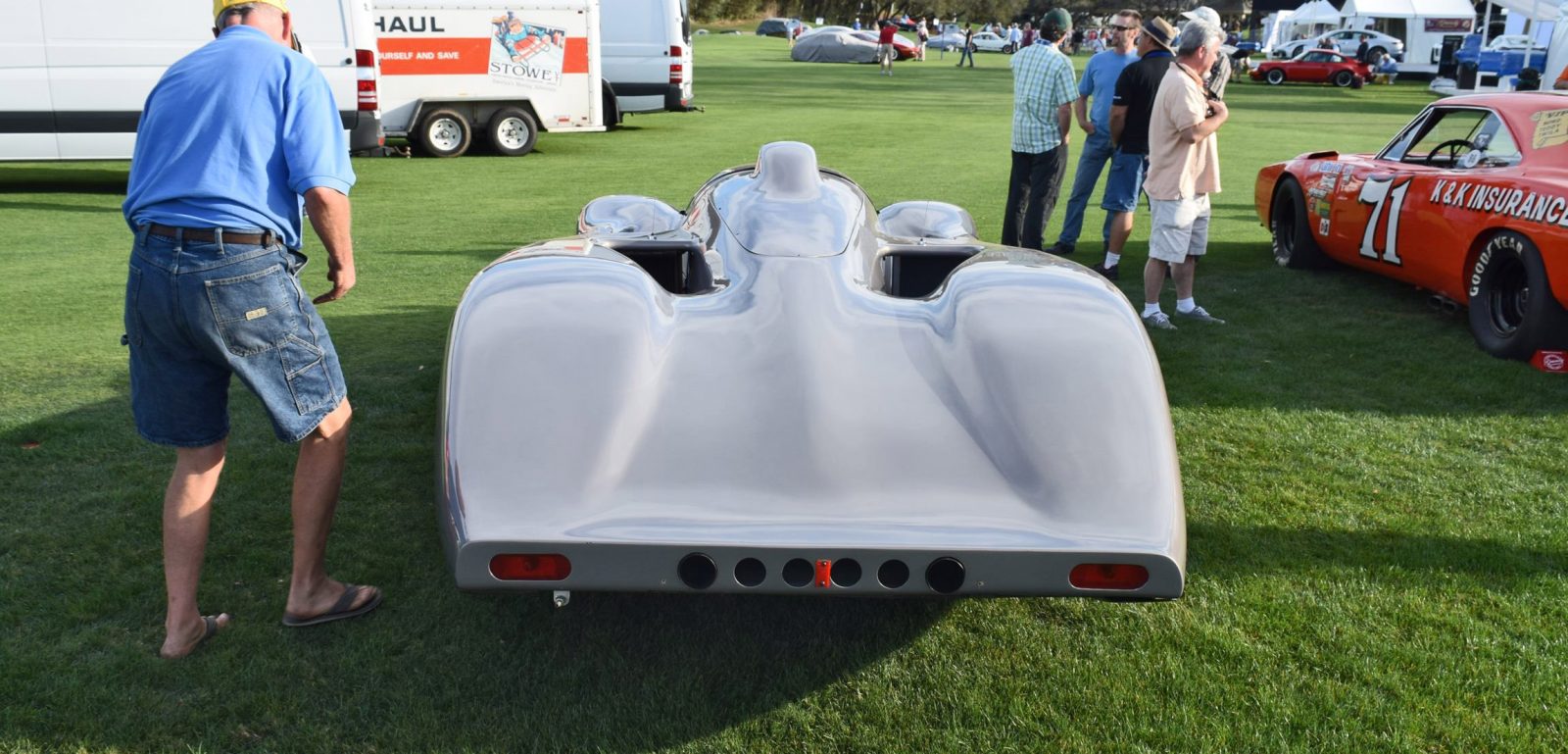

Featuring the Olds Aerotech at Amelia Island Concours

CRD Auto Industry Insider may contain helpful and on-topic partner content that auto enthusiasts and car shoppers find valuable.